Qingdao Globalstar Glass Co., Ltd.

Office address: No.6 Shandong Road, Qingdao,China

Factory address : No.656 Yuhai Road,Chengyang District,Qingdao,China.

View More >How to Import glass from China into the USA?

October 18, 20221. Choose the right glass supplier.

If you’re looking specifically for building glass, China has numerous suppliers within the field to choose from. Some Chinese window glass companies to look into are:

*Xinyi Glass Holdings Limited

*China Glass Holdings Limited

*AGC Glass

*Globalstar glass

*TAIWAN glass

2. Begin placing your orders.

Placing your first order is an exciting time.

If you are up to this stage of the game, it means you have found a great niche and a reputable supplier, and you’re about 90% ready to place an order.

You need to be as specific as possible and ask your supplier to confirm product specifications before both production and shipping.

When you have selected your supplier, request the Proforma Invoice for your prospective purchase.

When placing your first ever order or trying out a new supplier, it’s vital that you play it safe in order to avoid being scammed. This means before you go investing in a large order, start out small by just ordering a few items.

3. Pay for your products.

To place your order, you will have to pay a deposit on the value of your order. Usually an initial deposit of between 30-50% will be requested by a Chinese manufacturer to get your product/order into production. The remainder is paid upon delivery of the goods.

Remember that the wholesale cost of your product is not simply the recorded cost of the item on the order, but the total cost of having it shipped to you, including taxes, tariffs, shipping, and insurance fees.

You need to have a good estimate of the landing cost before you make your order. Landing cost = cost of the goods + transport costs by forwarder + import duties (if any) + local transport costs + cost of service providers (inspections, agents, etc.).

There may be many hidden costs and you can consult an import management company, but the best way to avoid bad surprises is by making a first order of a small quantity, and collect all costs

and fine tune your landing cost estimate.

4.Avoid payment fraud.

Some importers may experience this type of fraud when placing their orders. It typically involves their payment for orders being sent to the wrong bank account, which can leave both the supplier and the importer out of a large amount of money. Reduce your risk of this type of fraud by following two simple steps:

*Don't send your payment to a bank account that isn't registered under the name of the company you are ordering from.

*Don't send your payment to a bank account registered in a different city from your supplier, even if the name on the account is similar.

*Otherwise, you will simply lose your money and have virtually no legal recourse to get it back.

5. Getting Your Items Through Customs

①Hire a customs broker.

Locating and hiring a licensed customs broker can make your importation process much easier. This professional facilitates communication between you and the government, fills out and files necessary paperwork, and can help you navigate import regulations. They can also help estimate import costs and how long the import process will take. Just make sure that you can cover their fee with the sale of your imported products.

Neglecting compliance can be very costly. This may force you to pay expensive and unexpected customs duties, such as the anti-dumping duty, as well as risk delaying your customs clearance. This will cost you expensive storage fees at a railway station or container yard. Avoid these expenses by hiring a qualified customs broker.

Find a certified broker by searching on the website for the National Customs Brokers and Forwarders Association of America.

②File the Import Security filing (ISF).

The ISF is a document specific to items shipped by sea freight that provides advance shipment information to US Customs. This document should be filed 24 hours before shipment sets sail. If this is not done by either you or your broker, you may have to pay a $5,000 fine. The data points required on the ISF are:

*Identities of the buyer and seller.

*Importer of Record number.

*Consignee numbers.

*Country of Origin.

*Ship to party.

*Harmonized Tariff Schedule of the United States number (if your Chinese supplier has some export experience, he should have the harmonized schedule code, or HS code, for your product).

*Manufacturer or supplier information.

*Container stuffing location.

*Consolidator.

6. Submit initial import documents.

Once the goods are received by the port of entry, you (or your customs broker) have five days to submit the first round of required import documents. These must be accepted by customs before further documentation can be filed. Required documents include:

·*Bill of lading.

·*Packing lists.

·*Commercial invoice.

·*Certificate of origin.

·*Customs bond.

·*Inward cargo manifest or immediate delivery form.

File additional documents. After the first documents are accepted by the port of entry, you or your broker now have ten days to file two additional required documents. These are the entry summary (US Customs Form 7501) and any relevant invoices that can be used to value the shipment.

7. Taking Possession of Your Items and Pay your import duties.

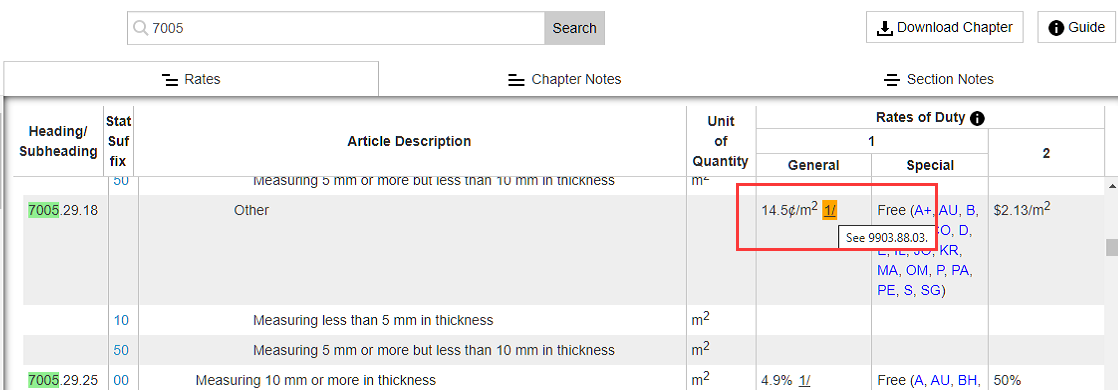

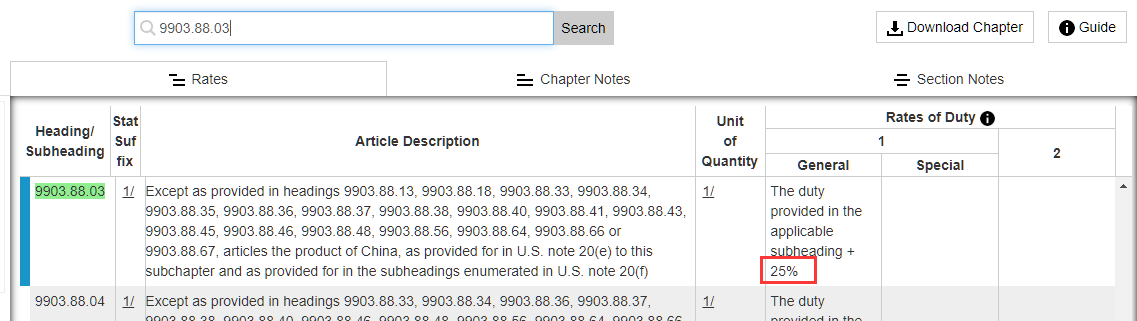

Your import duties will be calculated using the value of your shipment as estimated by customs officers and the shipment's grouping on the harmonized tariff schedule. The value of the shipments includes the price paid, commissions incurred from the purchase, royalty fees, license fees, packing costs, and the value of assists (specialized machinery or molds used in the manufacturing process). Your duties are then determined by using the tax rate specific to items of your shipment type on the US Government's Harmonized Tariff Schedule.

·Tariffs may vary by origin as well. For example, liquor (alcoholic beverages containing over 20 percent but no more than 50 alcohol by volume) is taxed at a standard rate of 8.4 cents per kilogram and an additional 1.9% of total value. However, this fee is waived when the items are coming from certain locations (including Canada and Singapore).

Glass Tariff details for clear plate glass:

Don't know how to search the HS CODE? Please don't hesitate to contact Globalstar glass.

·If any of your filed documents are inaccurate, you will need to file corrected documents before you can pay your duties.

·Your duties are due within ten days of the receipt of your initial import documents.

·Your customs broker should be able to help you estimate the cost of your duties before you import the goods.

8. Arrange for pick-up and transport.

Contact a commercial cargo company to arrange to have your shipment picked up at the port of entry and shipped to your warehouse or local resellers. Cargo companies can be located by consulting your local yellow pages or favorite online phone book.

9. Check your shipment for accuracy and damage.

Once the items have made it to you, look at the packaging and items themselves for any damage sustained over the course of the trip. If there is significant damage, you may want to rethink your choice of shipping method or urge your supplier to better prepare your items for shipment.

Have any questions about building glass?

Don't hesitate to contact us. As the professional glass manufacture, we could supply you competitive prices, follow up on production anytime with video, 100% Inspection before delivery, with CE,SGS,BV, ensure quality, and deliver products to your door. Globalstar glass specialists are very happy to help you and provide a variety of flexible and reliable solutions to help you solve various problems